Northern Ireland Central Investment Fund for Charities background

Established in 1965 through the Charities Act (Northern Ireland) 1964, the Northern Ireland Central Investment Fund for Charities (the Fund) aims to provide trustees of charities with the opportunity to invest all or part of their funds with the benefit of expert supervision. It is managed by the Department through recognised fund managers, and its investment policy is guided by a locally based Advisory Committee appointed by the Department, which meets in February, May, August and November each year.

The Fund operates as a discretionary managed fund. Participating charities pool their investments and are given a proportionate number of shares based on the most recent valuation (share price).

The Fund invests in fixed-interest securities and selected equities. The allocation between fixed-interest securities and equities is reviewed and adjusted periodically, in line with the Fund’s investment policy.

Current fund manager

The current fund manager is LGT Wealth Management (formerly abrdn) who are authorised and regulated by the Financial Conduct Authority.

Fund objective

The objective of the fund is to generate an income return in excess of the benchmark yield and thereafter long-term capital growth (+5 years) in real terms. The Fund manager has committed to achieving the aim of the Fund taking into account the following investment restrictions:

- no more than 5 per cent of the portfolio to be invested in any single issue (excluding Government Gilts and AAA rated Corporate bonds)

- no direct investment in tobacco related stocks

- no investment in securities that are not readily realisable

- no own company products without prior written approval

Northern Ireland Central Investment Fund for Charities Statement of Investment Policy

The Investment Policy Statement gives guidelines on the accountability standards in place to manage and monitor the performance of the Fund.

Fund performance

Latest valuation

At 30 June 2024, the capital share value of the fund was £54,448,457 and a single share/unit was valued at 1586.34 pence.

Key features of NICIFC

Aim - to achieve an annual income return in excess of the benchmark yield and thereafter long-term capital growth in real terms.

Eligibility - any charitable organisation may invest in the Fund provided it is based in Northern Ireland.

Benefit - investment in the fund should be viewed as long-term to achieve maximum benefit from capital growth. Benefit is also derived from dividend payments, which are paid bi-annually.

Risk Factors - based on the definitions of risk determined by LGT Wealth Management, the portfolio is categorised as being managed with a higher medium risk approach. The value of your investment may go down as well as up, as can the income from it.

Contributions - shares are allocated immediately after the next monthly valuation following receipt. There is no minimum contribution.

Withdrawals - these are processed at the next end of month valuation.

Valuation - completed as soon as possible after the end of the month but no later than the ninth working day of the following month.

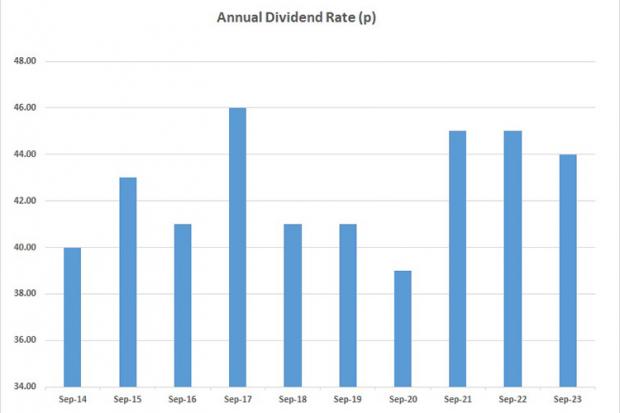

Dividends - paid bi-annually on 1 June and 1 December. No tax is deducted from dividends.

Capital Gains Tax - does not apply to charities.

Tax - claims are dealt with by the department.

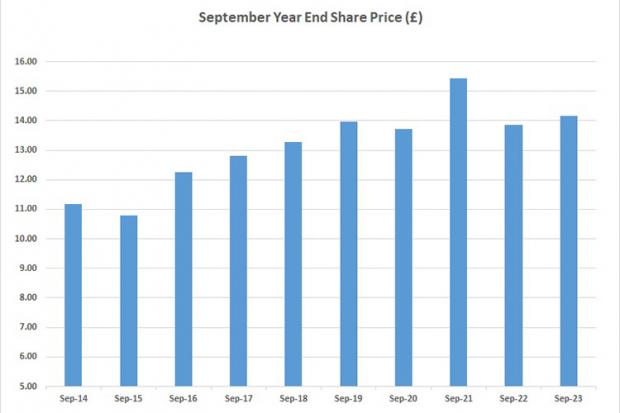

Performance - the shares were first issued in 1965 at £1 each.

Northern Ireland Central Investment Fund for Charities flyer

The flyer provides the key facts of the Fund.

Annual reports

- Northern Ireland Central Investment Fund for Charities Annual Report 2023

- Northern Ireland Central Investment Fund for Charities Annual Report 2022

- Northern Ireland Central Investment Fund for Charities Annual Report 2021

- Northern Ireland Central Investment Fund for Charities Annual Report 2020

- Northern Ireland Central Investment Fund for Charities Annual Report 2019

- Northern Ireland Central Investment Fund for Charities Annual Report 2018

- Northern Ireland Central Investment Fund for Charities Annual Report 2017

- Northern Ireland Central Investment Fund for Charities Annual Report 2016

If you require historic NICIFC Annual Reports please contact nicifc@communities-ni.gov.uk

Fact sheets

These fact sheets provide a quarterly overview of the performance and composition of the Fund.

- NICIFC fact sheet 31 March 2024

- NICIFC fact sheet 31 December 2023

- NICIFC fact sheet 30 September 2023

- NICIFC fact sheet 30 June 2023

Northern Ireland Central Investment Fund for Charities forms

Northern Ireland Central Investment Fund for Charities forms for shareholders to make withdrawals or change details:

Northern Ireland Central Investment Fund for Charities Conflict of Interest Policy with the Charities Commission Northern Ireland

The protocol document for the Northern Ireland Central Investment Fund for Charities and any perceived or potential conflicts of interest with the Charities Commission Northern Ireland.

Northern Ireland Central Investment Fund for Charities Advisory Committee Members

Biography of the members of the Northern Ireland Central Investment Fund for Charities Advisory Committee

David Murphy (Chair)

David is a Fellow of the Institute of Chartering Accountants with 25 years experience of public sector finances include strategic planning, service delivery, financial and investment management, preparation of accounts, compliance with Managing Public Money and risk management.

He is the Chief Executive (Accounting Officer) of the Northern Ireland Local Government Officers' Superannuation Committee which manages Northern Ireland's largest investment fund and provides pension services to over 120,000 members. As well as Mr Murphy's work for NILGOSC he is also an independent director of Northern Bank Pension Trust Limited.

David was appointed to the NICIFC Advisory Committee on 1 September 2016 and was appointed Chair on the 1 April 2019 for a 5 year term which will end on the 31 March 2024. This post is unremunerated.

Mr Andrew Turner

Mr Turner’s background is in the financial markets, where as a “Certified Person” under the Financial Conduct Authority certified regime he currently buys and sells fixed income securities with real money investment on a daily basis. He has also been the sole portfolio manager on a debt fund that looked at both local and hard currency debt, as well as experience of investing in emerging markets.

Andrew was appointed as a member to the NICIFC Advisory Committee on 1 October 2020 with a 4 year term which will end on the 30 September 2024. This post is unremunerated.

Mr Shane Lynch

Mr Lynch is a qualified engineer and has worked across the private, pubic and voluntary sectors, including as the Chief Executive Officer of the Utility Regulator, through which he has experience of constructively challenging utility providers, and as a Chairman of a Pension Fund Board of Trustees for six years. Through this fund he has experience of managing a private sector fund for the benefit of its members, in line with a trust deed and pension legislation.

Shane was appointed as a member to the NICIFC Advisory Committee on 1 October 2020 with a 4 year term which will end on the 30 September 2024. This post is unremunerated.

Mr Terence Hann

Mr Hann is currently working as a Portfolio Manager for Davy Private Clients UK. It is a front office role, within the investment function of the firm that is currently managing assets of over £1.3bn. His main responsibilities include performing daily risk and performance analytics on discretionary accounts and constructing bespoke portfolios for investors with unique investment constraints, skills of which he brings to the Committee. He holds no other public appointments and has not undertaken any political activity in the past five years.

Terence was appointed as a member to the NICIFC Advisory Committee on 1 May 2024 with a 4 year term which will end on the 30 April 2028. This post is unremunerated.

Miss Rebecca Hutchinson

Miss Hutchinson is a chartered accountant, having completed her ACA qualification with London-based firm, Saffery LLP. Here, she specialised in charities-specific audit and accounts preparation. She later worked as Director of Fund Finance at an investment manager based in Covent Garden. She was responsible for all internal and external financial reporting for two listed investment companies and a debt vehicle and, consequently, the regulatory compliance of over £300m of shareholder assets. She therefore has experience of board-level reporting, portfolio valuation and KPIs, asset allocation, dividend policy and UK listing rules. Miss Hutchinson currently works as Head of Finance in a construction company, which operates across the UK and Ireland. She holds no other public appointments and has not undertaken any political activity in the past five years.

Rebecca was appointed as a member to the NICIFC Advisory Committee on 1 May 2024 with a 4 year term which will end on the 30 April 2028. This post is unremunerated.

Mr Ben Murray

Mr Murray is employed as an Investment Manager for Quilter Cheviot Investment Management. His role involves the management of investment portfolios for private and charity clients and brings experience of main investment asset classes such as equities (both directly held and collective funds), bonds and property to the Committee. He has experience working alongside a wide range of clients and professional intermediaries. He holds no other public appointments and has not undertaken any political activity in the past five years.

Ben was appointed as a member to the NICIFC Advisory Committee on 1 May 2024 with a 4 year term which will end on the 30 April 2028. This post is unremunerated.

Charitable donations and bequests

Under the Charities Act (NI) 1964 and the Charities Order 1987 the Department acts as trustee to some 300 charities in the following circumstances:

- where donations are transferred by the existing charity trustees under Section 15 of the 1964 Act

- where there is uncertainty concerning the continued operation of the charity concerned

- where the trusteeship of the Commissioners of Charitable Donations and Bequests was transferred to the then Ministry of Finance in 1922 on the setting up of the Northern Ireland Government

It is the Department's policy to invest the capital of these charities in the Northern Ireland Central Investment Fund for Charities (NICIFC) unless prevented by the charity's governing instruments. Dividends from the NICIFC are received into the Charitable Donations and Bequests Account and paid over to local administrators on the Department's behalf.

Annual reports

These financial statements relate to the Charitable Donations & Bequests Accounts detailing receipts and payments for the financial year.

- Charitable Donations and Bequests Annual Report 2023

- Charitable Donations and Bequests Annual Report 2022

- Charitable Donations and Bequests Annual Report 2021

- Charitable Donations and Bequests Annual Report 2020

- Charitable Donations and Bequests Annual Report 2019

- Charitable Donations and Bequests Annual Report 2018

- Charitable Donations and Bequests Annual Report 2017

If you require historic CDB Annual Reports please contact nicifc@communities-ni.gov.uk

Contact

For further information, please contact nicifc@communities-ni.gov.uk